Team

Team

Vietnams Economic Prospects 2025

Author: Phan Vinh Quang, Le Van Phuc

The global economy showed signs of recovery in 2024, though it continued to face significant challenges such as armed conflicts, geopolitical tensions, climate change, and the housing crisis in China. The latest forecasts from international organizations suggest that the global economy will likely remain on a stable trajectory into early 2025, with inflation stabilizing. However, new risks are emerging, particularly following the announcement of import tariff increases by the incoming U.S. President Donald Trump.

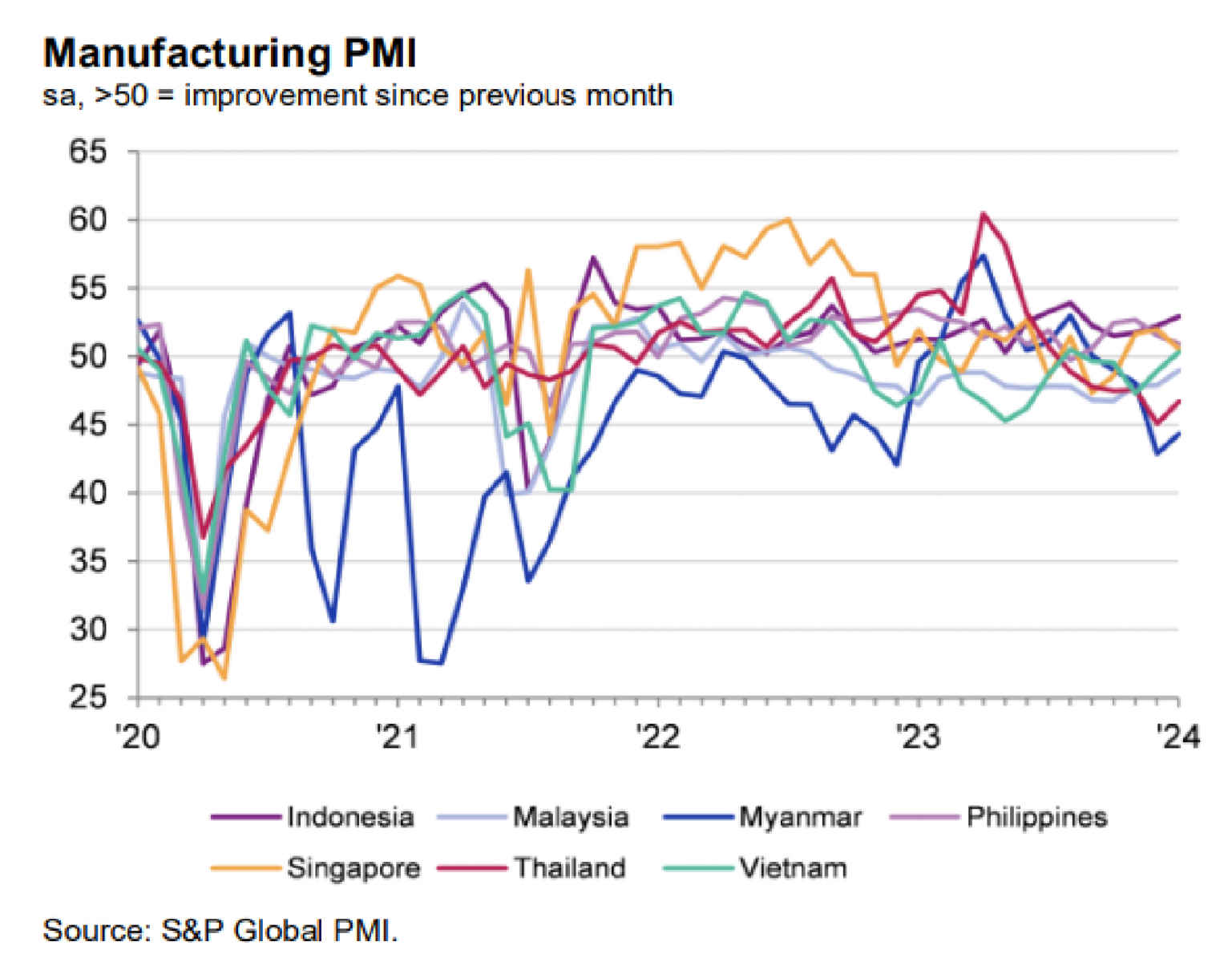

The year 2024 marked a pivotal moment for Vietnam’s economy as the country and its business community began to recover strongly after a period of hardship. Economic activity showed positive signs of recovery, with notable highlights including strong export growth, a robust industrial production sector, positive impacts from FDI, the revival of the tourism industry, and supportive fiscal and monetary policies from the government.

The business community has praised the government’s efforts in managing the macroeconomy in 2024, particularly in the face of many uncertainties in the global economy. Notable successes include maintaining the major economic balances, controlling inflation below target, achieving high economic growth compared to many other economies, and keeping interest rates low to support business operations. The year also saw success in economic diplomacy, with the establishment of comprehensive strategic partnerships with Australia, France, and Malaysia, successful negotiations of the Vietnam-UAE Free Trade Agreement, and the continued implementation of 16 existing FTAs, opening up new markets for Vietnamese businesses. The government’s efforts, led by the Prime Minister and various ministries, demonstrate the political system’s determination, which has been widely recognized and appreciated by the business community.

.png)

However, feedback from associations, industry representatives, and businesses indicates that the business environment still faces many challenges, such as: (i) Persistent legal bottlenecks that hinder business and investment activities, especially regarding tax management of related-party transactions, lengthy VAT refund processes causing frustration, difficulties in real estate mortgaging in industrial zones, issues with managing transport companies, and new regulations on food processing and fisheries; (ii) Output markets for several industries still face difficulties, with small order sizes, low prices, and the need to meet higher technical standards from buyers/brands; (iii) Businesses face rising input costs, exchange rate pressures, and challenges in accessing credit and preferential funds; (iv) Certain sectors (e.g., textiles, footwear, seafood, electronics, food processing, and wood) and regions (especially in southern industrial hubs) struggle to recruit labor to meet production needs; (v) The pressure of dual transformation - digitalization and green transformation to meet sustainable development goals.

Looking ahead to 2025, Vietnam’s trade and production activities are expected to continue their recovery and growth trajectory, particularly as major economies begin to loosen monetary policies, especially in key export markets like the U.S. and EU. A large public investment disbursement plan is expected to become one of the key drivers of economic growth, alongside exports and the shifting FDI flows. The trend of diversifying supply chains to friendly countries, coupled with Vietnam’s efforts to maintain political stability and active economic diplomacy, establishing comprehensive strategic partnerships with major global economies, and participating in multiple FTAs, creates great opportunities for businesses to integrate deeper into global supply chains.

The new tariff policy from the incoming U.S. president is expected to have a varied impact on trade and Vietnam's economy over time. In the short term, Vietnam could take advantage of increased imports from large global buyers to rush before the new tariff policies are implemented. However, in the medium to long term, Vietnam needs to closely monitor U.S. tariff policies and trade protection measures, particularly for products like electronics, machinery, textiles, footwear, and wood products, which represent the largest export values to the U.S. and are also heavily dependent on imports from China. The impact of these policies is expected to affect Vietnam in the latter months of 2025. Potential risks could be mitigated through negotiations between Vietnam and the U.S. to balance trade activities.

Vietnam’s growth outlook continues to be influenced by escalating risks, such as geopolitical instability from the Russia-Ukraine conflict and the Middle East, the threat of global inflation, the trend of increased trade protectionism, uncertainty about Chinese economic policies, high demands from importing countries for supply chain transparency and environmental standards, as well as the ongoing impacts of climate change and natural disasters. Domestically, the banking system's non-performing loans (especially concerning with the expiration of Circular 02 on debt extension at the end of 2024), prolonged weaknesses in the corporate bond and real estate markets, slow resolution of legal barriers to business operations, delays in establishing regulations for emerging sectors (such as the digital economy, green economy, and circular economy), a cumbersome public administrative system, and inefficiency continue to hinder the economy's stability and recovery.

To foster breakthrough economic growth in 2025 and the years to come, Vietnam needs to quickly implement solutions to improve traditional growth drivers and promote new growth drivers.

Traditional growth drivers include: boosting private investment, accelerating public investment projects, improving infrastructure, strengthening traditional export markets, expanding into new potential markets, stimulating domestic consumption, addressing institutional bottlenecks, and improving the business environment (especially resolving issues in the real estate market and streamlining the administrative apparatus). Specific measures include: (i) Extending tax, fee, and levy support policies until the end of 2025 to alleviate input costs for businesses and stimulate domestic consumption; (ii) The government should instruct ministries, sectors, and localities to quickly issue guidance on amendments to the Investment Law and Financial Laws, as well as resolutions to address real estate market difficulties and investment projects; (iii) Swiftly removing legal barriers in the business environment, such as tax management for related-party transactions, VAT refund processes, and issues related to real estate mortgaging in industrial zones.

New growth drivers are key to Vietnam’s economic leap towards a new era of development. This includes policies supporting the private sector to foster leading enterprises, promoting dual transformation (digitalization and green transformation), circular economy, innovation, moving toward higher-value segments in global supply chains, and shifting the economy toward high-tech industries (AI, semiconductors, electric vehicles). Specifically: (i) Vietnam should develop policies to support private enterprises, particularly small and medium-sized enterprises, to enhance the economy's internal strength, and establish a “National Program to Support Pioneer Enterprises in Global Value Chains,” providing a roadmap and policy framework for businesses to bring “Made by Vietnam” products to global markets; (ii) Reforming and developing a modern financial market that can integrate with regional and international financial markets is also a priority; (iii) Vietnam must intensify efforts in green transformation, digitalization, and circular economy to drive the transition to a high-income economy; (iv) Enhancing workforce quality, improving infrastructure, and ensuring energy supply through effective implementation of the Electricity Master Plan VIII, alongside improving the investment and business environment.

Resources liên quan

- A Snapshot of IPSCs Accomplishments

- The Workforce for an Innovation and Start-up Ecosystem

- Support for Public Financial Management with the Ministry of Finance of Vietnam

- GRAFT Challenge Vietnam 2021 Launched To Scale Up AgriTech Firms

- Vietnam Fintech Ecosystem 2017

- Private Enterprise Development Toolkit

- Vietnam PPP Support and Implementation

- “Formalization” Of Household Business In Vietnam

- Entrepreneur And Venture Support Programs In Ho Chi Minh City, Da Nang, Phnom Penh

- International Best Practices On Supporting Startup Ecosystems

- International Best Practices In Business Support Services

- Manual Of The Korean Business Incubator Model